The cryptocurrency market continues to evolve with innovative projects that push the boundaries of decentralized finance (DeFi), stablecoin utility, and community-driven token narratives. Among the tokens gaining traction recently are River USDT and Pippin USDT, two crypto assets that have seen heightened attention from traders and investors. While neither is a traditional stablecoin themselves, both are closely connected to crypto ecosystems where USDT (Tether) — the world’s dominant stablecoin pegged to the US dollar — plays an important role in trading, liquidity, and valuation.

This article dives into what makes these projects unique, how they function in the broader crypto space, and why their developments matter to anyone tracking stablecoin-linked tokens and DeFi infrastructure.

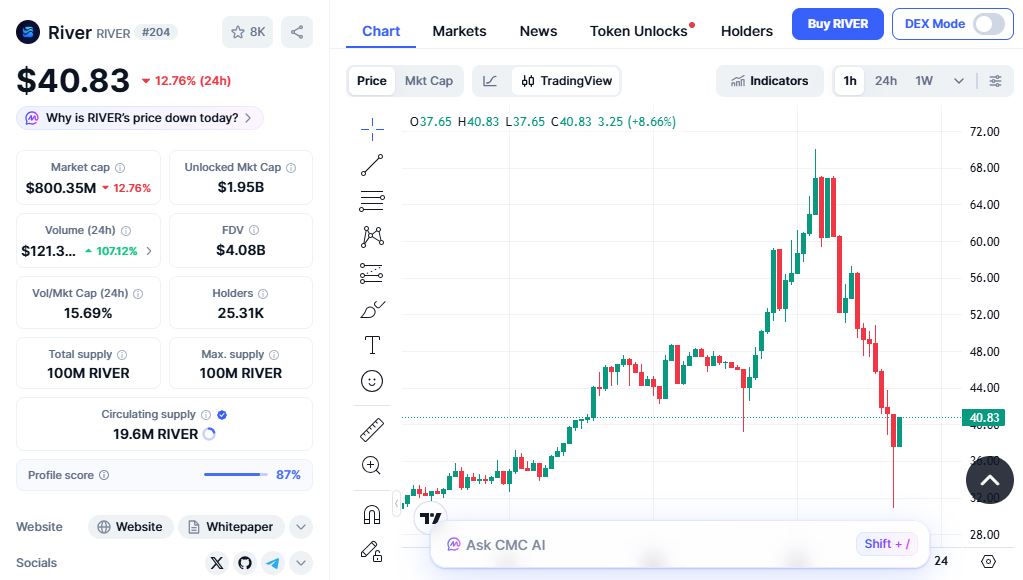

What Is River (RIVER) and Its Connection to USDT

River is a decentralized finance protocol that aims to create a chain-abstraction stablecoin infrastructure designed to make cross-chain liquidity seamless, efficient, and secure. The project’s core innovation is the Omni-CDP system, which allows users to collateralize digital assets (such as BTC, ETH, and other supported coins) on one blockchain and mint a stablecoin called satUSD on another — all without traditional bridging mechanisms.

River’s native token, RIVER, serves multiple purposes within the ecosystem:

- It provides governance rights, allowing token holders to participate in protocol decisions.

- It offers incentive mechanisms and rewards tied to DeFi use cases.

- It supports ecosystem growth through staking, yield strategies, and liquidity provisioning.

Although RIVER itself isn’t a stablecoin, its interactions with USDT pairs on exchanges — where users can trade RIVER/USDT — tie its market performance to USDT liquidity and demand. The RIVER/USDT trading pair has become one of the key ways investors access the token’s market performance, highlighting the role Tether’s stablecoin plays as a backbone for trading emerging crypto assets.

Recently, River has been at the center of market attention due to significant developments in both funding and ecosystem expansion. TRON founder Justin Sun invested $8 million in the River Protocol, a move that boosted confidence and led to sharp increases in the token’s price while sparking debate over leverage-driven trading activity among analysts.

River has also formed strategic partnerships — including collaborations with the Sui Network to integrate its satUSD stablecoin and multi-chain liquidity solutions — strengthening its position as a next-generation DeFi infrastructure project.

Despite strong growth metrics and market momentum, analysts caution that short-term price movements — driven by speculative volume and derivatives trading — may not always reflect long-term adoption patterns, emphasizing that RIVER remains a highly dynamic and evolving token.

How River’s satUSD Stablecoin Works and Why It Matters

A central component of River’s value proposition is satUSD, the protocol’s omni-chain stablecoin. Unlike conventional stablecoins that are issued directly on a single blockchain, satUSD leverages River’s chain-abstraction technology to enable users to:

- Lock collateral on one blockchain (e.g., Ethereum or BNB Chain).

- Mint a stablecoin equivalent on another blockchain.

- Use that stablecoin in multi-chain DeFi activities without traditional token bridges.

This capability aims to solve one of DeFi’s persistent challenges — liquidity fragmentation — by allowing capital to flow across ecosystems more seamlessly and efficiently. satUSD also underpins yield products, lending pools, and decentralized financial instruments that rely on a stable asset that’s backed by collateral.

The involvement of USDT in trading pairs (RIVER/USDT) further underscores how stablecoins support deep liquidity for emerging tokens like RIVER, even when those tokens themselves are rooted in novel financial infrastructure innovations.

What Is Pippin (PIPPIN) and Its Relation to USDT

Pippin ($PIPPIN) is an AI-driven meme coin and autonomous character project built on the Solana blockchain, combining whimsical branding with cutting-edge artificial intelligence narratives that capture both crypto culture and experimental technology.

Originating from an AI-generated SVG unicorn image that evolved into a broader community project, Pippin operates as more than a simple meme coin. It embodies an AI agent framework that autonomously performs activities based on an internal memory loop — creating a unique blend of crypto and AI storytelling.

In trading contexts, PIPPIN frequently pairs with USDT, as is common with most altcoins on decentralized exchanges and centralized trading platforms. These PIPPIN/USDT pairs allow investors to measure PIPPIN’s real-time value relative to the US dollar and facilitate easier entry and exit from positions without exposure to volatile base assets like BTC or ETH. Current data shows that 1 PIPPIN trades at approximately 0.398 USDT, reflecting both market sentiment and recent price movements.

While PIPPIN’s core appeal is cultural and speculative — blending meme-coin enthusiasm with AI narratives — it has experienced notable price surges and high market cap spikes, often driven by whale accumulation, concentrated supply movements, and derivatives trading dynamics that have sparked debate about sustainability and volatility.

Comparing River and Pippin: Utility vs Culture

Although both River and Pippin have connections to USDT trading pairs, they represent different ends of the crypto spectrum:

- River is rooted in DeFi infrastructure and aims to redefine cross-chain stablecoin utility while facilitating liquidity and governance functions in multi-chain contexts.

- Pippin is a community-driven meme/Ai token, thriving on social engagement, branding, and speculative momentum rather than fundamental financial infrastructure goals.

Both tokens benefit from USDT liquidity — a stable reference point against which traders measure performance and execute entry/exit strategies — but they attract distinct investor profiles: River appeals to DeFi innovators and infrastructure investors, while Pippin draws meme-coin speculators and those intrigued by AI narratives in crypto.

Risks, Volatility, and Investor Considerations

Tokens like RIVER and PIPPIN illustrate the wide spectrum of crypto token use cases, but they also highlight the risks inherent in emerging markets:

- Price volatility — rapid fluctuations driven by speculation can impact investors sharply.

- Concentrated supply effects — whale accumulation or unlock events can trigger sudden liquidity swings.

- Regulatory uncertainty — stablecoin regulation and DeFi compliance remain evolving global issues, influencing token utility and exchange listings.

Thus, while both projects showcase innovation and growth potential, market participants should conduct thorough research and consider risk management strategies before engaging deeply with either RIVER or PIPPIN tokens.

This article is part of FFRNEWS Finance coverage, examining the evolving role of crypto tokens tied to stablecoin liquidity and DeFi infrastructure. Content has been compiled from market data and news reports including updates on the River Protocol’s strategic investments and cross-chain stablecoin technology notated by Justin Sun’s involvement and protocols expanding satUSD use, as well as analyses of the PIPPIN meme token’s market performance and AI-driven token profile that blends crypto community culture with autonomous agent narratives.