A renewed Bitcoin influencer warning is spreading rapidly across crypto markets after a prominent digital asset commentator predicted that Bitcoin could fall as low as $30,000, reigniting fears of a deeper correction. While such forecasts remain speculative, the warning reflects growing unease among traders and investors as volatility grips global financial markets.

The prediction has gained traction on social media and trading forums, where investors are increasingly sensitive to influential voices amid falling prices, declining liquidity, and broader economic pressure affecting risk assets worldwide.

Who Issued the Bitcoin Influencer Warning

The warning came from a widely followed crypto market analyst and influencer known for macro-cycle analysis and long-term Bitcoin trend modeling. In a recent post shared across X and Telegram, the influencer argued that Bitcoin has entered a prolonged bearish phase, with historical patterns pointing toward a deeper retracement before any sustainable recovery.

According to the influencer, Bitcoin’s failure to hold recent support levels signals that the market may be heading toward a major psychological zone near $30,000, a level last seen during previous downturns.

This commentary quickly gained momentum, amplifying concern among retail traders who closely track influencer sentiment during periods of uncertainty.

Why the $30,000 Level Is Central to the Warning

The $30,000 price level holds symbolic and technical importance in Bitcoin’s history. Influencers and analysts often highlight it as a major accumulation and breakdown zone from past market cycles.

The influencer behind the latest Bitcoin influencer warning noted that if current selling pressure continues, algorithmic trading models and long-term moving averages could drag prices toward that level. They emphasized that this would not necessarily mark the end of Bitcoin’s long-term potential — but could represent a painful reset phase.

Market participants have reacted strongly because influencer-led narratives often influence short-term sentiment, especially during volatile conditions.

How Influencer Commentary Shapes Crypto Markets

Unlike traditional finance, cryptocurrency markets are heavily influenced by social media voices, particularly during periods of high volatility. Influencers with large followings can accelerate fear or optimism, triggering rapid shifts in trading behaviour.

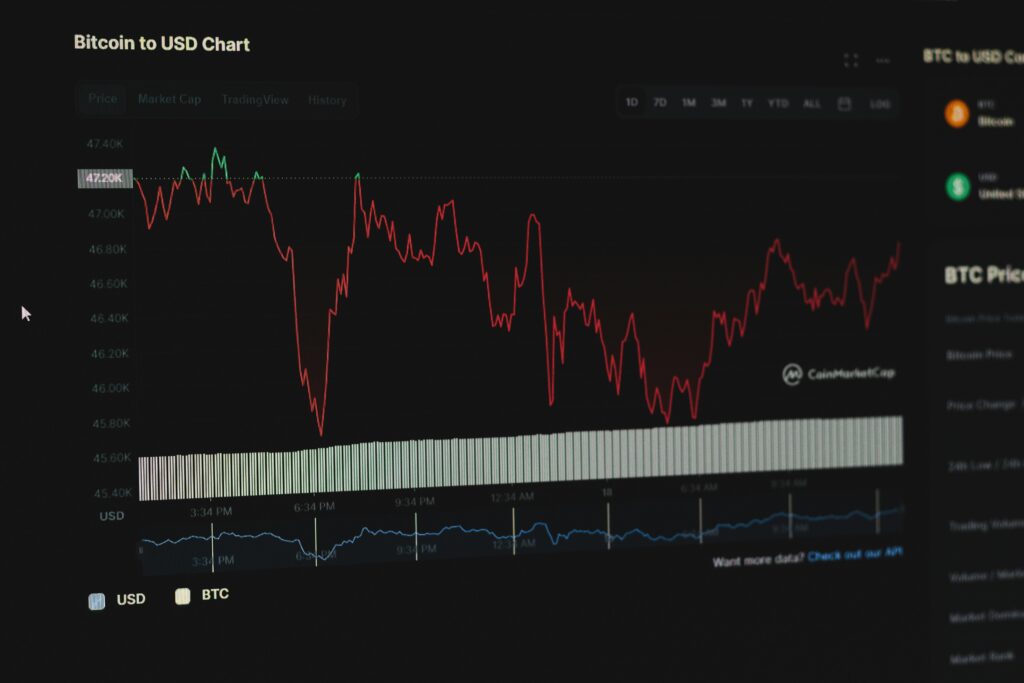

In this case, the Bitcoin influencer warning coincided with an increase in bearish positioning across major exchanges, suggesting that traders are at least partially pricing in the possibility of further downside.

Historically, similar influencer warnings have preceded both sharp declines and eventual rebounds, making them closely watched indicators rather than definitive forecasts.

Market Conditions Reinforce Influencer Concerns

The influencer’s warning did not emerge in isolation. Bitcoin has recently struggled amid:

- Weak risk appetite across global markets

- Reduced liquidity in speculative assets

- Heightened uncertainty over monetary policy

- Increased selling pressure from short-term holders

These factors have created an environment where bearish influencer commentary gains amplified attention. As prices drift lower, caution tends to dominate narratives, reinforcing the warnings shared by prominent crypto voices.

Investor Reaction to the Bitcoin Influencer Warning

Following the influencer’s comments, market sentiment indicators showed a noticeable shift toward fear. Crypto forums, trading dashboards, and social feeds reflected growing concern about whether Bitcoin could revisit significantly lower levels.

Some investors view the warning as a signal to reduce exposure or wait on the sidelines, while others interpret it as a potential long-term buying opportunity should such a decline materialise.

This divergence highlights the speculative nature of influencer-driven forecasts — influential, but far from guaranteed.

Skeptics Push Back Against Influencer Doom Forecasts

Not all analysts agree with the bearish outlook. Several market observers argue that influencer warnings often become most vocal after major declines, rather than before them.

Critics point out that Bitcoin has historically recovered from deep drawdowns and that long-term adoption trends remain intact. They caution investors against making decisions solely based on influencer predictions, urging a balanced view that incorporates on-chain data and macroeconomic indicators.

Still, even skeptics acknowledge that influencer warnings can shape short-term market psychology.

Why This Influencer Warning Matters Now

Timing is a crucial factor. The current Bitcoin influencer warning arrives at a moment when markets are already fragile, magnifying its impact.

When prices are stable, bearish forecasts tend to fade quickly. But during downturns, they can act as catalysts — reinforcing fear, accelerating sell-offs, and shaping narratives across the crypto ecosystem.

For this reason, even speculative influencer predictions can have outsized influence on near-term price action.

What Traders and Investors Should Watch Next

As the Bitcoin influencer warning continues to circulate, market participants are closely monitoring:

- Whether Bitcoin can reclaim key resistance levels

- Changes in trading volume and liquidation data

- Broader risk sentiment across equities and commodities

- Additional commentary from other high-profile crypto voices

If prices stabilise, the warning may fade. If not, the $30,000 level could become a focal point of market discussion in the weeks ahead.

Conclusion: Influencer Warning Reflects a Market on Edge

The latest Bitcoin influencer warning underscores how fragile sentiment has become across digital asset markets. While the prediction of a $30,000 drop remains speculative, it reflects a broader atmosphere of caution as investors grapple with volatility, tightening financial conditions, and uncertain macro signals.

Whether the forecast proves accurate or not, the reaction to it highlights the continued power of influencer narratives in shaping crypto market psychology — especially during moments of heightened uncertainty.

This report draws on crypto market commentary and analysis reported by Hindustan Times and FFR Finance, covering influencer forecasts and current Bitcoin market conditions.