November 06, 2025

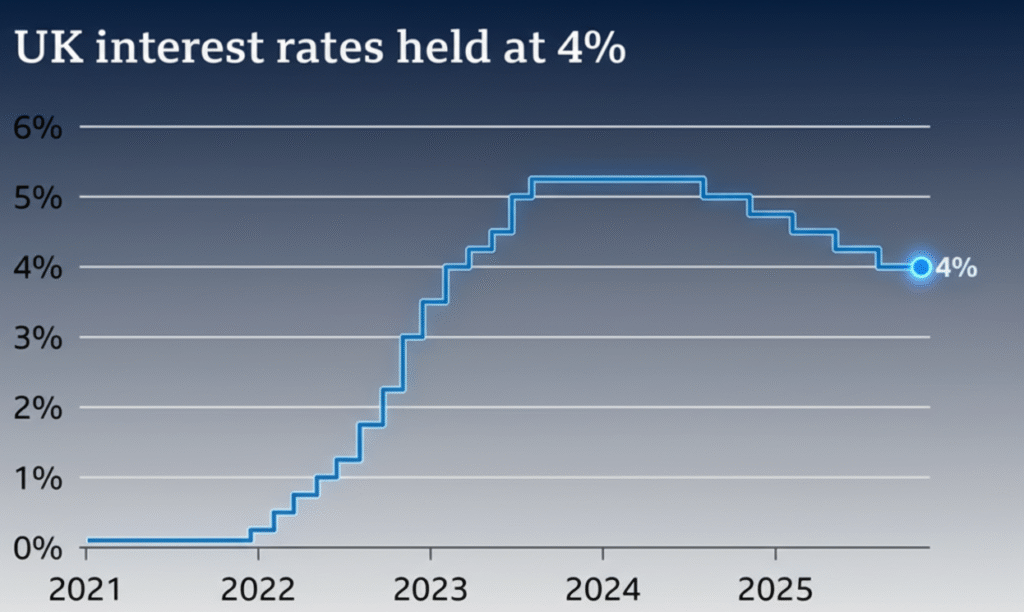

Bank of England inflation decision has once again taken center stage as the UK’s central bank voted narrowly to keep interest rates steady at 4%, signaling that inflation has likely peaked. The move reflects a cautious approach amid signs that the cost-of-living crisis is beginning to ease—though challenges for households and businesses persist.

The Monetary Policy Committee (MPC) voted 5-4 in favor of maintaining the current rate, with Governor Andrew Bailey emphasizing that it was still too early to cut borrowing costs. Bailey said he would “prefer to wait and see” if price rises continue to cool through the rest of the year before making any policy adjustments.

Inflation Peaked, But Risks Remain

The Bank of England inflation decision comes as the UK’s inflation rate stands at 3.8%, nearly double the Bank’s target of 2%. While inflation has slowed significantly from its 2022 highs, officials remain concerned that price pressures could resurface—particularly in energy, food, and services sectors.

The Bank’s report noted, “There is no sign of increasing consumer confidence,” adding that households remain cautious, saving more and spending less. Supermarket data revealed that food sales growth is being driven primarily by price increases, not higher sales volumes.

Markets Await December’s Potential Rate Cut

Analysts see the November decision as a temporary pause rather than a policy shift. Yael Selfin, chief economist at KPMG UK, said the close vote “underscores the uncertain backdrop policymakers are navigating ahead of the Budget.”

She added that “the door remains open for a rate cut at the December meeting,” provided inflation data continues to trend downward.

Similarly, Paul Dales of Capital Economics predicted that this is “a pause in the downward trend in interest rates rather than the end,” suggesting cuts could resume within months.

Government Response and Political Tensions

Chancellor Rachel Reeves responded to the Bank’s forecast, saying inflation is “due to fall faster than previously predicted.” However, speculation continues that Reeves may raise taxes during the November 26 Budget, including income tax, National Insurance, or VAT—moves that could breach key Labour manifesto pledges.

Meanwhile, Shadow Chancellor Mel Stride criticized Reeves, accusing her of “reckless borrowing” and warning that the UK remains trapped in a “doom-loop” of high inflation and weak growth.

Consumers Still Under Pressure

Despite signs of easing inflation, many UK households continue to feel the pinch. High mortgage rates, stagnant wages, and rising childcare costs have led some workers to reduce hours or leave the workforce altogether. Businesses, too, remain cautious—holding off on hiring and investment until after the Budget.

The Bank projects the unemployment rate will hit 5% by year’s end and remain around that level through 2028. Growth forecasts are modest: 1.5% in 2025, 1.2% in 2026, rising slowly to 1.8% by 2028.

What It Means for Borrowers and Savers

For UK consumers, the Bank of England inflation decision means mortgage rates are likely to remain steady for now. The central bank’s base rate heavily influences borrowing costs and returns on savings, so any future rate cuts could reduce monthly repayments—but also lower savings yields.

Financial analysts recommend that homeowners and investors monitor December’s MPC meeting closely, as it could determine whether the UK officially begins its rate-cutting cycle heading into 2026.

The Road Ahead for the UK Economy

The Bank’s cautious stance underlines the delicate balance between curbing inflation and supporting growth. With consumer confidence weak and business investment subdued, the UK’s path toward economic stability remains uncertain.

However, if inflation continues to fall and the global energy situation stabilizes, the Bank of England’s inflation decision could mark the turning point toward a more sustainable recovery.

For more insights on UK and global market trends, visit FFR News Business.

Source:

BBC News