The AI HPC Bitcoin miners market witnessed a major rally as Advanced Micro Devices (AMD) shares surged 30% following news of a landmark multi-billion-dollar deal with OpenAI. The agreement, which could give OpenAI up to a 10% equity stake in AMD, marks one of the most significant partnerships in the rapidly expanding artificial intelligence and high-performance computing (HPC) sectors.

According to the Financial Times, OpenAI has agreed to purchase tens of billions of dollars’ worth of AMD chips, further intensifying competition in the AI chip market dominated by NVIDIA. The deal could redefine the infrastructure backbone of AI computing globally, particularly as OpenAI aims to scale its compute capacity for next-generation AI models.

A Record-Breaking Deal in AI Infrastructure

The OpenAI-AMD partnership represents a historic move in terms of financial and technological scale. The chips procured under this deal are expected to deliver a total computing power capacity of 6 gigawatts (GW). Industry analysts estimate that 1 GW of capacity costs roughly $50 billion to develop, considering both chip fabrication and data center infrastructure.

This extraordinary level of investment highlights how the AI and HPC industries are evolving into multi-trillion-dollar sectors. It also underscores how companies like AMD are transforming from component suppliers into strategic infrastructure partners for AI leaders.

AMD’s shares skyrocketed to around $225, reflecting a 30% gain in a single day — one of its largest intraday surges in recent years. Market watchers see this as a vote of confidence in AMD’s ability to compete with NVIDIA, whose GPUs currently dominate AI training and inference workloads.

Ripple Effect Across AI and Bitcoin Mining Stocks

The announcement sent shockwaves through the broader AI-linked and Bitcoin mining sectors, many of which rely on similar HPC infrastructure. Shares of leading AI miners and crypto-focused computing firms surged in Monday’s U.S. trading session.

- Bitfarms (BITF) gained 8%.

- IREN (IREN) climbed 12%, hitting all-time highs around $56.

- Hive Digital (HIVE) rose 12%.

- Cipher Mining (CIFR) advanced 7%.

- CleanSpark (CLSK) and TerraWulf (WULF) both added 5%.

The rally demonstrates growing investor confidence in companies positioned at the intersection of AI computation, blockchain validation, and high-efficiency energy infrastructure. As AI workloads grow more data-intensive, Bitcoin miners with existing high-density data centers are increasingly pivoting toward AI/HPC hosting for diversification and profitability.

Galaxy Digital’s Strategic Expansion into AI/HPC

Among the biggest beneficiaries of this AI infrastructure boom is Galaxy Digital (GLXY). The firm, known for its strong presence in digital assets, has now expanded aggressively into AI/HPC operations.

Galaxy recently converted its Helios campus into a large-scale AI/HPC data center, reflecting its belief that high-performance computing and blockchain will increasingly converge. In August, Galaxy secured $1.4 billion in project financing to retrofit the facility and later signed a long-term lease agreement with CoreWeave (CRWV) for up to 800 MW of compute capacity.

Following the AMD-OpenAI news, Galaxy Digital’s stock surged another 5%, continuing a rally that has seen GLXY shares rise 116% year-to-date. This increase was fueled not only by the AI sector’s momentum but also by Galaxy’s broader diversification — including the launch of GalaxyOne, a wealth management platform offering 4% yield on FDIC-insured cash and seamless investments into crypto and U.S. equities.

The Convergence of AI, Crypto, and HPC

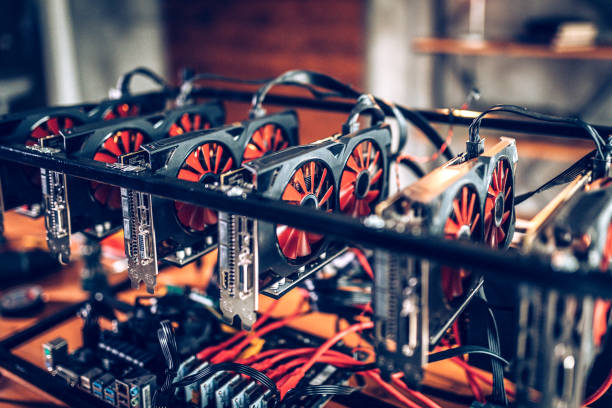

The AMD-OpenAI partnership is being hailed as a pivotal moment for the convergence of artificial intelligence, blockchain technology, and high-performance computing. As AI workloads require massive compute power and decentralized infrastructure, crypto miners are emerging as unexpected but logical collaborators in this new technological ecosystem.

Experts predict that AI-HPC mining could become a multi-billion-dollar hybrid industry, where Bitcoin miners repurpose existing hardware and renewable energy infrastructure for large-scale AI workloads. Companies with pre-established energy contracts, cooling systems, and security measures stand to benefit the most.

Meanwhile, OpenAI’s decision to diversify its chip suppliers beyond NVIDIA could introduce much-needed competition into the GPU market, potentially reducing costs and increasing innovation across the industry.

Market Outlook and Future Implications

The ongoing AI and HPC infrastructure expansion is reshaping traditional market correlations. Investors are increasingly viewing AI-linked mining firms not just as crypto plays, but as infrastructure providers to the broader digital economy.

If AMD maintains its momentum and delivers on OpenAI’s ambitious compute capacity goals, it could solidify its position as a dominant player in next-generation AI hardware. Analysts are already forecasting further upside for AMD stock as institutional investors pile in.

As for the Bitcoin mining sector, the continued integration of AI computing workloads could diversify revenue streams and stabilize profitability, particularly amid Bitcoin’s volatility. Many industry observers believe this synergy between AI and mining could define the next wave of digital infrastructure innovation.

Source: CoinDesk