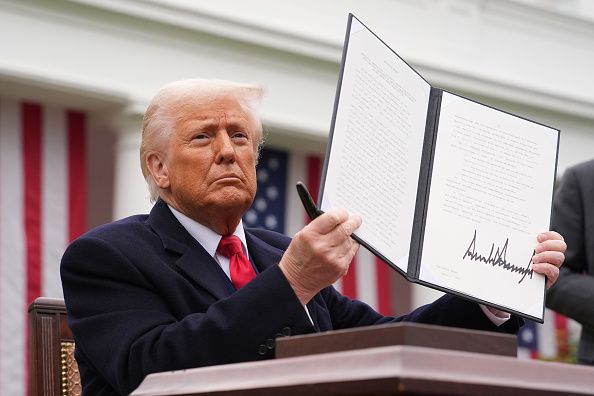

Trump new tariffs are once again at the center of international attention as the US President announced a sweeping new set of import duties targeting multiple industries. From branded pharmaceuticals to heavy-duty trucks and furniture, these measures are set to reshape trade flows, increase consumer costs, and escalate tensions between Washington and its trading partners.

The latest tariffs include:

- 100% levy on patented or branded drugs starting 1 October unless companies have factories in the US.

- 25% tax on heavy-duty truck imports, designed to shield American manufacturers.

- 50% duties on kitchen and bathroom cabinets and 30% on upholstered furniture, extending the scope of protectionism into consumer goods.

This move comes despite repeated warnings from US business groups and international partners that further tariffs could harm both industries and consumers.

Pharmaceutical sector in the spotlight

The boldest aspect of Trump new tariffs is the 100% duty on branded pharmaceutical imports. While generic medicines and US-based manufacturers are exempt, the move threatens to disrupt supply chains across Europe and Asia.

The European Federation of Pharmaceutical Industries and Associations called for “urgent discussions,” warning of possible harm to patients if tariffs restrict availability of essential drugs.

However, experts like Neil Shearing, chief economist at Capital Economics, noted that the impact may not be as large as feared, since many major firms already produce in the US or have plans to expand local manufacturing.

UK pharmaceutical exports, worth over $6 billion annually to the US, could face particular strain, though companies like GlaxoSmithKline and AstraZeneca have positioned themselves with multi-billion-dollar US investments that may shield them from tariffs.

Tariffs on trucks and cabinets

The 25% import duty on heavy trucks is aimed at protecting American manufacturers such as Peterbilt and Mack Trucks. Trump argued that the measure prevents “unfair outside competition” and boosts domestic jobs.

However, the US Chamber of Commerce has warned that the move could backfire. Medium and heavy-duty truck production in the US relies heavily on imported parts from Mexico, Canada, Germany, and Japan. With more than half of US truck imports coming from Mexico and Canada alone, sourcing all components domestically may be impractical, driving up costs for both manufacturers and consumers.

The 50% levy on kitchen and bathroom cabinets, along with 30% on upholstered furniture, has rattled the retail and housing sectors. Swedish giant Ikea expressed concern, saying the tariffs “make doing business more difficult” and will likely increase consumer prices.

Wider trade and political implications

Trump new tariffs are part of his broader protectionist trade agenda in his second White House term. Earlier this year, sweeping tariffs on more than 90 countries took effect, covering industries like steel, copper, cars, and electronics.

Trade analysts argue the latest measures are both political and economic. By targeting industries with significant domestic lobbies—such as trucking and furniture—Trump appeals to US workers while simultaneously seeking to secure tariff revenues as broader global duties face legal challenges.

Deborah Elms of the Hinrich Foundation described the approach as “terrible for consumers” since higher import costs will inevitably push up retail prices.

Internationally, the tariffs threaten to strain relations with key allies. The EU maintains that pharmaceutical exports should be capped at a 15% tariff under a framework agreed earlier this year, potentially setting up another trade dispute. The UK government has already voiced concern, pledging to engage with Washington to protect its pharmaceutical industry.

Global reactions and future outlook

Reactions to Trump new tariffs have been mixed. Supporters in the US manufacturing sector argue that the measures are necessary to protect jobs, rebuild industry, and counter what Trump calls the “flooding” of imports into the country.

Critics, however, warn of rising consumer prices, reduced global cooperation, and retaliation from trade partners. With global supply chains deeply interconnected, tariffs on one industry often ripple across others.

The question now is whether these tariffs will succeed in boosting US manufacturing or whether they will instead deepen uncertainty in global trade markets. As October approaches, pharmaceutical firms, truck manufacturers, and furniture retailers worldwide are bracing for impact.

Source: BBC News